Guide to New Zealand Budgeting Practices

Budget allowances

Operating allowance

The operating allowance is the pool of net new operating funding available at each Budget for new policy initiatives or cost increases in existing policy. The operating allowance can be allocated either to expenditure or revenue policy changes. Because most of the operating allowance is usually allocated to expenditure, it is often referred to as an allowance for new spending.

The allowance is often set in advance of Budget in accordance with the Government's fiscal strategy, and is usually presented as an annual average amount of net new operating funding available across the current financial year (2023/24) and next four financial years (2024/25-2027/28).

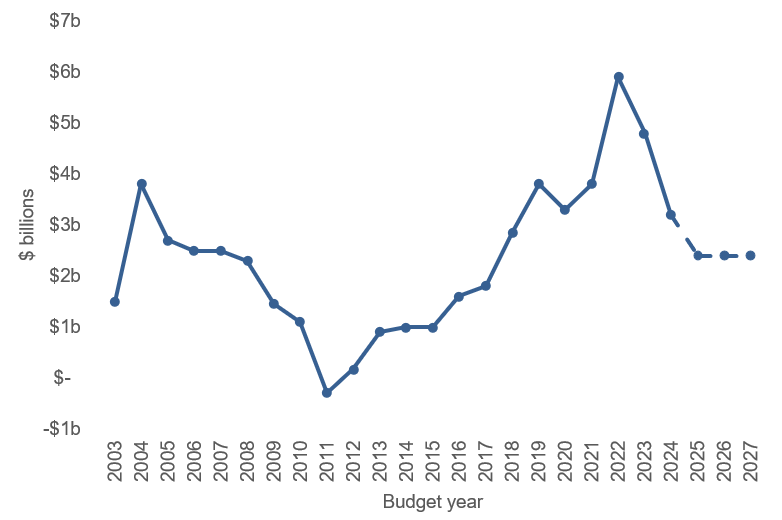

The graph below shows the average per annum operating allowances from Budget 2003 to Budget 2027.[3]

Figure 1 - Operating Allowances form Budget 2003 to Budget 2027

The operating allowance forms a self-imposed cap on expenditure growth (less any revenue changes). Because most government expenditure does not automatically adjust for inflation, it is generally expected that changes to expenses and new revenue policies are funded from the operating allowance.

However, some notable exceptions where changes to operating expenses and revenue are managed outside the operating allowance include:

- Changes in the cost of debt servicing, the Jobseeker Support benefit or tax revenue (but not tax rates) to help avoid pro-cyclical fiscal policy.[4]

- Impairments and revaluation and other changes due to large assets and liabilities (these items are highly volatile, and are often non-cash).

- Previously forecast growth in expenditure, most notably New Zealand Superannuation.

In addition to creating a cap on expenditure, the allowance approach also incentivises prioritisation. The decision-making phase of the Budget process requires Ministers to discuss relative priorities and make trade-offs with the aim of forming a package of high-value initiatives that achieve their priorities that fits within allowances. This is why most new spending proposals are considered through the Budget process.

When producing forecasts of future spending, future operating allowances are included to give the most accurate picture. Decisions already made are allocated to the relevant area, while unallocated amounts are shown as forecast new operating spending even though some may be used for revenue changes. This means that for areas where most growth in spending is expected to be funded from the operating allowance, forecasts of future spending do not necessarily reflect the most likely future spend in that portfolio.

Notes

- [3] Over time, allowances have been communicated in different ways. In some years, the Budget operating allowance has been communicated as the final outyear impact of net new operating spending and revenue policy changes. More recently, however, the Budget operating allowance has been communicated as the four-year average per annum impact. The graph shows the average per annum impact of each Budget, so the number presented may differ from the allowance that was communicated at the time.

- [4] Pro-cyclical fiscal policy is either, expansionary (increased spending or tax cuts) fiscal policy in a boom or contractionary (reduced spending or tax increases) during a trough or recession. This is generally avoided in order to better manage the economic cycle. For example, if unemployment rises in a time of economic recession and the government were to charge this cost against the operating allowance it would crowd out other spending which could risk exacerbating the downturn.