ECONOMIC CONTEXT

The economic outlook has deteriorated significantly since the Half Year Economic and Fiscal Update (HYEFU) in December. To illustrate this, the Treasury has produced a forecast scenario, drawing on preliminary economic forecasts prepared in advance of the Budget.[2]

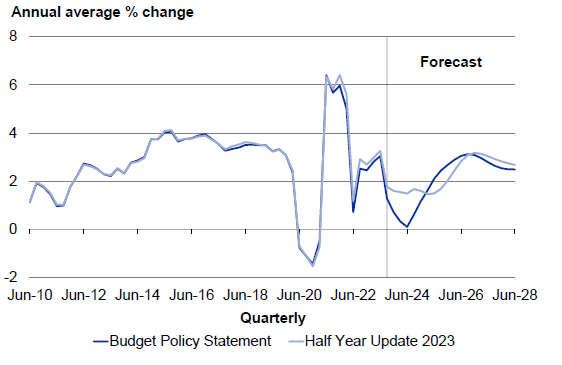

GDP data for the September quarter of 2023, released after the HYEFU was finalised, was much lower than forecasters had predicted. Statistics New Zealand also made substantial downward revisions to growth in earlier quarters. Together, these results indicate that the New Zealand economy was materially weaker in recent years than previously thought (Figure 1). In terms of labour productivity, they indicate that each hour of labour input has resulted in less output than previously estimated. While Treasury expects labour productivity to improve over the next few years, the improvement comes off a lower base. As a result, the assumption of potential growth that underpins the Treasury’s real GDP forecast has been lowered.

Figure 1 - Real GDP growth

Sources: Stats NZ, the Treasury

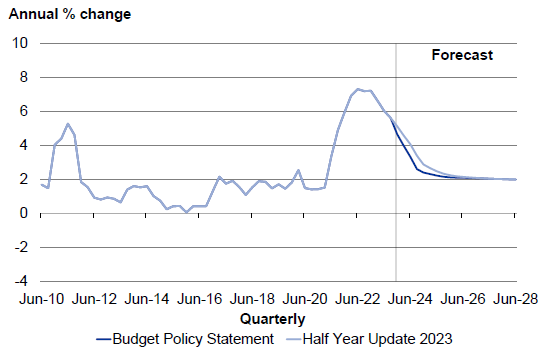

These changes, together with a revised inflation track (Figure 2), result in lower nominal GDP in each year of the forecast period (to 30 June 2028). This downgrade in nominal GDP flows through to lower tax revenue. By the end of the forecast period, the cumulative level of nominal GDP in Treasury's economic scenario is $42.8 billion lower than forecast at the HYEFU and core Crown tax revenue is $13.9 billion lower. In particular, core Crown tax revenue is around $3 billion lower in 2026/27 and around $4 billion lower in 2027/28, compared to the HYEFU forecast.

Figure 2 - CPI inflation

Sources: Stats NZ, the Treasury

These revisions to the economic outlook will have a negative impact on the Government's fiscal position. For example, HYEFU forecasts showed an operating balance before gains and losses (OBEGAL) surplus of $140 million in 2026/27 and $3.4 billion in 2027/28. All else being equal, the revisions to forecast tax revenue will reduce the HYEFU operating balances by around $3 billion in 2026/27 and around $4 billion in 2027/28.

Further revisions to GDP and tax revenue are likely in the Budget Economic and Fiscal Update (BEFU) and inevitable in the medium term. With the economy estimated to be at a turning point, there is elevated uncertainty about the economic and fiscal outlook, as illustrated by large revisions in recent updates. In the BEFU, the Treasury intends to publish further information on uncertainty around its forecasts.

Note

- [2] See accompanying Treasury document: Economic and Tax Outlook, The Treasury, 27 March 2024.