FISCAL STRATEGY

The operating balance and government spending

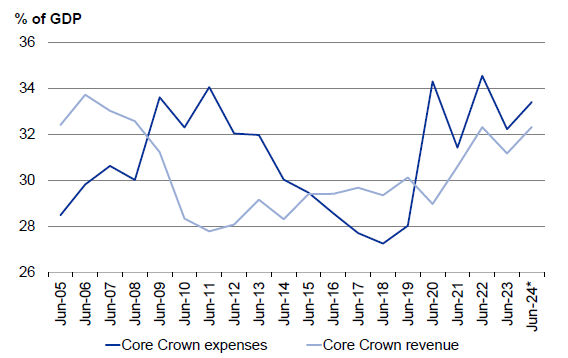

The OBEGAL - the difference between government revenue and government spending (before gains and losses) - has been in deficit since 2019/20. This has largely been driven by an increase in core Crown expenses.

Figure 3 - Core Crown revenue and expenses

* Forecast core Crown revenue and expenses for the year to June 2024 is from the HYEFU forecasts.

Source: The Treasury

While some spending was temporary - for example, in response to the COVID‑19 pandemic and the North Island weather events - there was a structural increase in other areas of spending. Between 2016/17 and 2023/24 (forecast), core Crown expenses have grown 84 per cent, compared to a 52 per cent increase in nominal GDP and a 66 per cent increase in core Crown revenue. Budget operating allowances over the last four years - Budgets 2020 to 2023 - have averaged around $4.5 billion compared to $1.4 billion between 2010 and 2019, and a considerable amount of spending was done outside of allowances.

The structural increase in spending means that the Government would be in deficit - and would need to borrow to cover this deficit - even if the economy was operating at full capacity. This is not sustainable. Fiscal consolidation is required over time to bring revenue and expenses back into balance. Tight fiscal policy in the near term will also support monetary policy to bring inflation within target, and maintain it there.

The Government's strategy for managing expenditure is to embed a culture of responsible spending, restore fiscal discipline, right-size the government's footprint and improve the efficiency and productivity of spending. This will not be achieved in a single Budget. International evidence is that reducing deficits is best done over the course of several years and should be focused on structural reforms to expenditure and revenue settings.

As signalled in the Speech from the Throne in December 2023, the Government's intention is to reduce core Crown expenditure as a proportion of the overall economy. In the longer term, the Government's objective is to reduce core Crown expenses towards 30 per cent of GDP. This year, core Crown expenses are forecast (in the HYEFU) to be 33.4 per cent of GDP, and have been above 30 per cent of GDP since 2019/20.

An operating surplus will be achieved via a steadily improving OBEGAL trajectory. A specific timeframe for returning to surplus will be set out in the FSR, when a complete set of updated fiscal forecasts and projections will be available. It would be premature to identify a surplus date now, based on incomplete information.

OBEGAL is a total Crown measure, so includes the results of Crown entities (CEs) and state‑owned enterprises. Over the forecast period, CEs are expected to make a significant negative contribution to OBEGAL. For example, the HYEFU showed deficits from the Accident Compensation Corporation (ACC) of $3.3 billion per annum on average over the 2024-2028 period, flowing straight into the OBEGAL.

A key tool in controlling expenditure growth and returning to surplus is setting tight but realistic spending allowances across the forecast period. Budget 2024 will have an operating allowance of less than $3.5 billion, with the exact number to be confirmed in the Budget. $3.5 billion was the size of the Budget 2024 operating allowance at HYEFU.

Operating allowances for Budgets 2025 to 2027 will be set out in the FSR.