Debt

The Government's approach to public debt is that operating expenses should be funded out of operating revenue over time, with debt being used for three purposes:

- as a smoothing device, to allow automatic fiscal stabilisers such as tax revenue and unemployment benefit spending to operate across the economic cycle

- as a buffer in the event of an economic shock such as a natural disaster or financial crisis, and

- to fund high quality investments that provide benefits to New Zealand over time, including those that increase the productive capacity of the economy.

New Zealand's debt has increased rapidly in recent years. Some, but not all, of this increase was due to COVID-19. Using its own internationally comparable measure of debt, the International Monetary Fund estimated that debt in New Zealand rose more than all 33 countries in its advanced economy grouping over the COVID-19 period, apart from the United Kingdom and Malta.

In 2009, the Government adopted net core Crown debt as its headline indicator and specified its long-term debt objective in these net debt terms. Net debt includes financial assets as well as financial liabilities, and better reflects the underlying strength of the Crown balance sheet.

In 2022, the previous Government revised this measure by adding the assets of the New Zealand Superannuation Fund (NZSF), core Crown advances and CE borrowing.

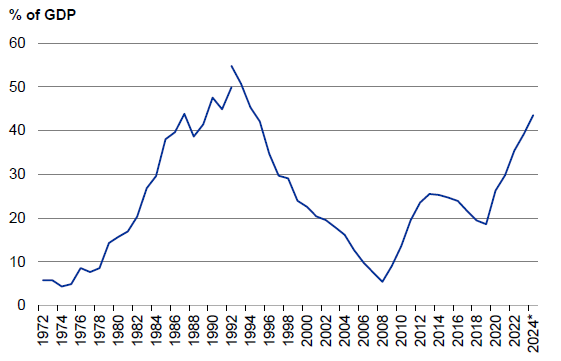

The Government is changing the headline net debt indicator back to the established, 2009 definition of net core Crown debt. While there were some good reasons for introducing the 2022 measure, and Treasury will continue to report it, the Government is concerned that the inclusion of NZSF assets introduces too much volatility to a headline measure. Moreover, returning to the 2009 measure provides greater clarity over how the current size of debt, and the Government's debt objectives, fit into a historical context.[3] Net core Crown debt is currently 44 per cent of GDP - around the same as it was in the mid-1990s (Figure 4).

Figure 4 - Net core Crown debt

* Forecast net core Crown debt for the year to June 2024 is from the HYEFU forecasts.

** The disjunct in the chart is because the measure of net core Crown debt adopted in 2009 is only restated back to 1992. An earlier measure of net core Crown debt which included advances is shown for the period before 1992.

Source: The Treasury

In 2022, the previous Government adopted a net debt ceiling of 50 per cent of GDP (translated into the 2009 net core Crown debt measure). While the Government accepts that 50 per cent of GDP can be considered the upper bound of prudence on debt sustainability grounds - based on Treasury modelling[4] - it should not be a target. New Zealand needs a healthy balance sheet buffer as, in comparison to many other countries, we are a small economy, vulnerable to natural disasters, reliant on commodity exports and dependent on international debt markets. Shocks can rapidly increase debt. Figure 4 illustrates the impact of the global financial crisis and the COVID-19 pandemic on New Zealand's debt, being major contributors to the increase in net core Crown debt from 5 per cent of GDP to 44 per cent of GDP in only 16 years.

The Government is also conscious of the interest burden of public debt. Finance costs have increased from both higher interest rates and increased debt issuance. In the current financial year, finance costs are forecast in the HYEFU to be $8.8 billion, which is around $1 billion higher this year than government operating spending on the Defence Force, the Police, Corrections and Customs combined.

The Government therefore intends to put net core Crown debt on a downward trajectory. Once it is below 40 per cent of GDP, the Government intends to maintain net core Crown debt within a band of 20 to 40 per cent of GDP. Relative to the previous Government's 50 per cent ceiling, this objective reduces the risk that future shocks could rachet up debt to a level at which severe corrective action is required.

The range of 20 to 40 per cent of GDP recognises that pursuing very low levels of public debt can involve forgoing opportunities for productive investment.

Notes

- [3] The 2009 measure of net core Crown debt does not include borrowing by CEs. Much of this borrowing is from the government itself and is therefore of no concern from a debt perspective. Kāinga Ora (KO), however, issued bonds between 2018 and 2022, with the approval of the previous Government. As this debt was issued at a premium to Government bonds, it led to an unnecessary increase in the cost of Government debt, as well as reducing oversight of KO’s financial decisions. The Government does not intend to repeat this experiment with KO or other CEs and will consider amending legislation to prevent it happening in the future. KO currently has approximately $7.5 billion of bonds outstanding, and most of these bonds will mature by 2030.

- [4] The Treasury's analysis and recommendations for fiscal rules. The Treasury, May 2022: https://www.treasury.govt.nz/publications/guide/treasurys-analysis-and-recommendations-fiscal-rules