Operating allowances

Spending restraint is the Government's key top-down tool to ensure its fiscal strategy is realised. In Budget 2025, this restraint has three elements. First, there will be a high bar for new initiatives in the Budget – these will be limited to the most important Government priorities. Second, savings will need to be found, beyond those already identified in the previous Budget. And third, with a small number of exceptions, government departments should expect to receive no additional funding in the Budget.

Each government department is now required to prepare a Performance Plan that describes how the department will deliver outputs, and manage cost pressures, within a set baseline of funding. Performance Plans must be clear about any trade-offs and set out how risks can be managed. They are a tool that puts the focus on medium-term sustainability, rather than on annual Budget initiatives.

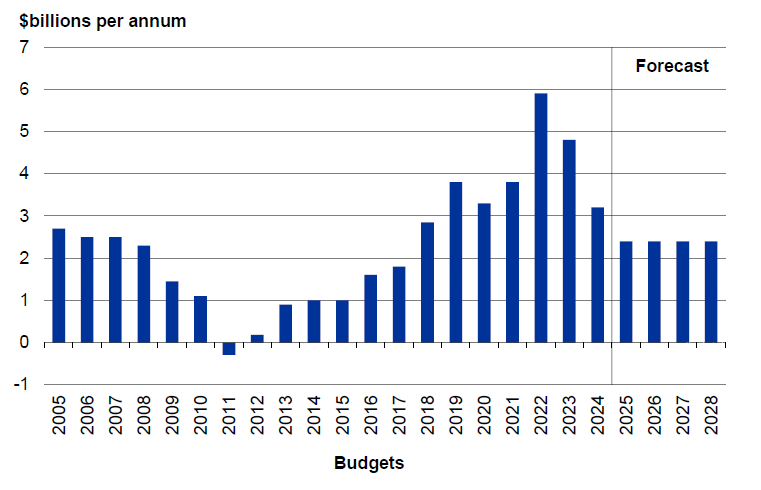

The operating allowances for Budgets 2025, 2026 and 2027 will remain at $2.4 billion per annum.[1] The operating allowance for Budget 2028 has also been set at $2.4 billion per annum. These are tight allowances, particularly compared to those for Budgets 2018 to 2023 (Figure 3).

Figure 3 - Budget operating allowances

Source: The Treasury

As the section below on the fiscal outlook shows, maintaining tight operating allowances drives a reduction in core Crown expenses as a percentage of GDP over the forecast period, and therefore an improving operating balance.

In Budget 2024, the Government pre-committed $1.37 billion per annum against the Budget 2025 operating allowance to meet forecast demographic, volume and price pressures for frontline health services delivered by Health New Zealand. It subsequently pre-committed funding for additional medicines, including up to 26 cancer treatments. After pre-commitments, and some non-discretionary forecast items, there is currently around $700 million per annum remaining in the operating allowance for Budget 2025.

Managing within that remaining allowance will be challenging. It is important to remember, however, that operating allowances are a net concept - they include spending, savings and revenue initiatives within a single envelope. For example, the Budget 2024 allowance accommodated $9.1 billion of spending and tax relief, together with $5.9 billion of savings and revenue raising, netting out to $3.2 billion of new operating spending on average per annum.

Note

- [1] Operating allowances are amounts allocated in the forecasts for net new operating spending on discretionary policy initiatives in future Budgets.