The operating balance indicator

Over time, governments in New Zealand have used a variety of indicators to communicate their short-term operating balance intentions - the total Crown operating balance, OBERAC (operating balance excluding revaluations and accounting policy changes), OBEGAL excluding New Zealand Superannuation Fund retained revenue and, since December 2008, OBEGAL.

OBEGAL is a total Crown measure. It is the difference between the revenue and expenses (before gains and losses) of not just the core Crown,[3] but also Crown entities and State-owned enterprises, over which the Government exerts less direct control in the short-term. In recent years, Crown entity deficits have grown in prominence. In 2023/24, Crown entities collectively contributed $6 billion, or close to half, of the total OBEGAL deficit of $12.9 billion.

The FSR stated there would be a review of operating balance indicators. It identified that having Crown entity deficits in OBEGAL risks undesirable fiscal policy responses, as some entities, like the Accident Compensation Corporation (ACC), are set up to be self-funded and aim to be financially sustainable over the long run, even when running large deficits in particular years. Box 2 sets out the Government’s decisions following this review.

Box 2 - Review of operating indicators

The Government has decided that its key short-term fiscal intention for the operating balance will “look through” the results of ACC. Having ACC in the headline operating indicator gives too much weight to the point-in-time position of a self-sustaining, long-term insurance scheme, which should have no impact on tax and spending decisions elsewhere in government. ACC is a long-term scheme set up, for the most part, to be fully funded, supported by its current asset base of around $50 billion. The appropriate time frame for considering its financial sustainability is the long term, not the next four years. There are no risks to ACC's financial condition significant enough to affect its ability to pay claims over the short to medium term.

There are several reasons ACC can be running a deficit before gains and losses. First, a significant portion of ACC’s investment revenue – which reduces the amount required from levies – is from changes in the value of its assets, and is therefore excluded from the OBEGAL measure. On this basis alone, it is likely that, on average, forecasts would show an ACC deficit before gains and losses each year. Second, if accounts are more than fully funded (as the Motor Vehicle and Work Accounts currently are), ACC’s funding policy requires that levies be set lower than the cost of new claims, to reduce the accounts over time towards a 100 per cent funding ratio. Third, for a variety of reasons, levies may not be sufficient in a particular year to cover the cost of new claims. In this case, any concerns about financial sustainability can be addressed by improving long-term scheme performance or through future levy decisions.

These considerations have previously been relevant but were of less concern when ACC's results were modest compared to total OBEGAL. ACC's deficit is now significant, as well as volatile. Over the last three years, ACC's deficit before gains and losses rose from $1.0 billion in 2021/22 and $2.2 billion in 2022/23 to $4.1 billion in 2023/24. Its deficit is forecast to average around $4 billion per annum over the forecast period.

This prominence in OBEGAL creates incentives for undesirable, and unnecessary, short-term policy responses. Ministers approve ACC levies and should not be tempted to set levies at higher rates than justified by the scheme’s funding policy, simply to improve OBEGAL. Similarly, Ministers should not contemplate raising taxes or reducing spending, either of which would have an enduring impact, to compensate for ACC deficits in pursuit of a short-term OBEGAL intention. In future, ACC may run a surplus and, following the same logic, this should not be a license to reduce taxes, ramp up government spending, or set levies at lower rates than are justified by the funding policy.

In setting its short-term fiscal intentions, the Government will therefore use a new measure of OBEGAL excluding ACC revenue and expenses - “OBEGALx”. The review found that no other government entities could at present be considered self-funding in the same way as ACC.

The change described in Box 2 does not diminish the Government's focus on ACC. That focus will be on ACC's long-term performance and future levy track, not on its impact on OBEGAL in any particular year.

Government funding for the Non‑Earners' and Treatment Injury Accounts will be captured in OBEGALx as this funding is included in core Crown expenses.

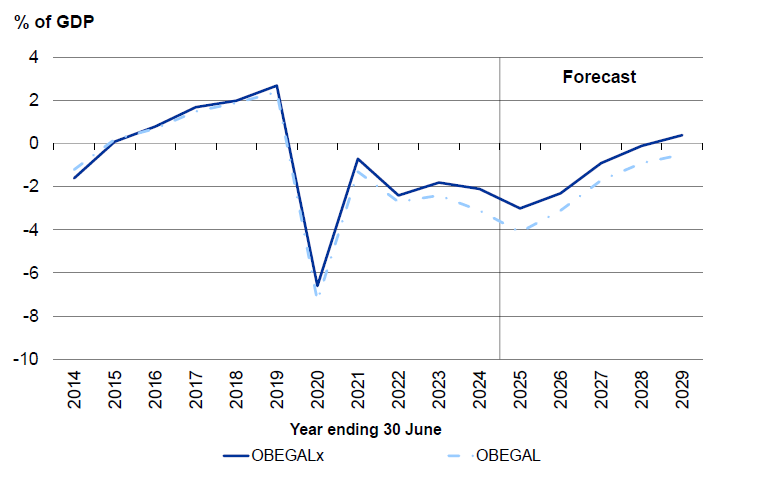

The Treasury will continue to report OBEGAL (that is, including ACC) in its economic and fiscal updates. Outturns and forecasts for OBEGAL and OBEGALx are shown in Figure 4, which illustrates the growing prominence of ACC in recent years.

Figure 4 - OBEGALx and OBEGAL

Source: The Treasury

Note

- [3] A reporting segment consisting of the Crown, departments, Offices of Parliament, the NZ Super Fund and the Reserve Bank.