Annex 1 - Review of fiscal operating indicators

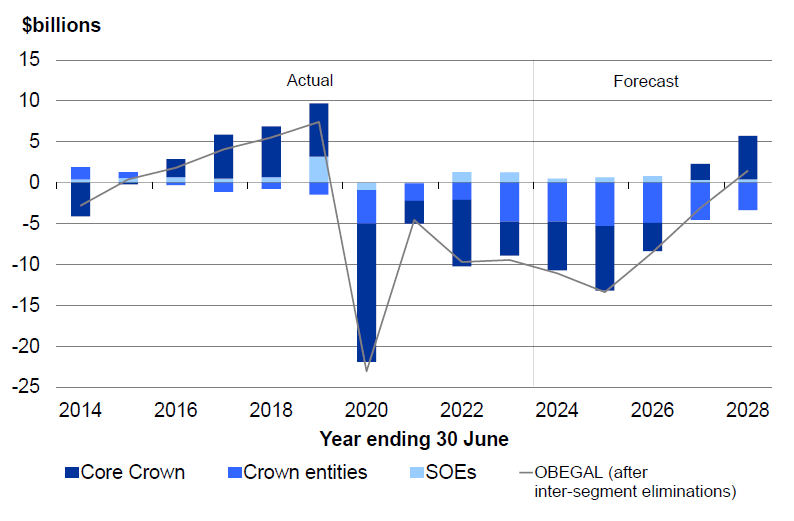

OBEGAL provides a comprehensive flow measure of the Government’s financial performance. It excludes market fluctuations in asset and liability valuations that are highly variable and not within the direct control of the Government in the short term. As a whole of Government measure, it includes the results of Crown entities (CEs) and state-owned enterprises (SOEs).

Figure 12 — Composition of OBEGAL

Source: The Treasury

Over the forecast period, CEs are expected to make a significant negative contribution to OBEGAL in net terms (i.e., contribute to deficits), on average by $4.6 billion per annum. ACC is currently the main contributor to the aggregate CE deficits, with forecast deficits of $3.4 billion per annum on average over the forecast period.

To achieve the Government's fiscal goals, increases in the OBEGAL deficits of these entities currently need to be offset by larger surpluses or smaller deficits from the core Crown. This could be undesirable from a fiscal strategy perspective since some entities (like ACC) are self-funded and aim to be financially sustainable over the long run, even when running large OBEGAL deficits in particular years. For this reason, there is an argument to exclude from an operating indicator self-funded entities that are deemed to be fiscally sustainable, since they are unlikely to require additional Government funding. On the other hand, exclusion of these entities may result in reduced fiscal transparency.

The Treasury will undertake a review of operating indicators to consider these arguments, with a focus on how the financial flows of entities that are intended to be self-funded affect the Government's fiscal strategy. The review will also explore whether alternative indicators, such as the core Crown OBEGAL or operating balance, could better guide and communicate the Government's fiscal goals. Debt indicators are out of scope of the review.