Annex 3 - Alternative fiscal projection scenarios

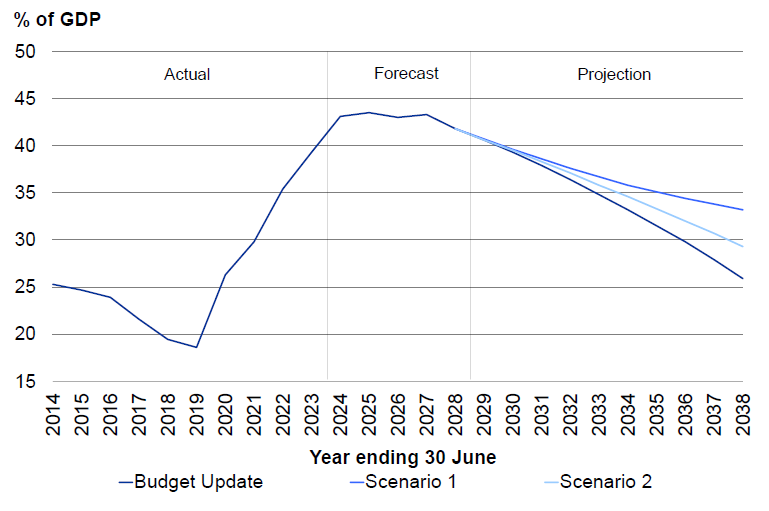

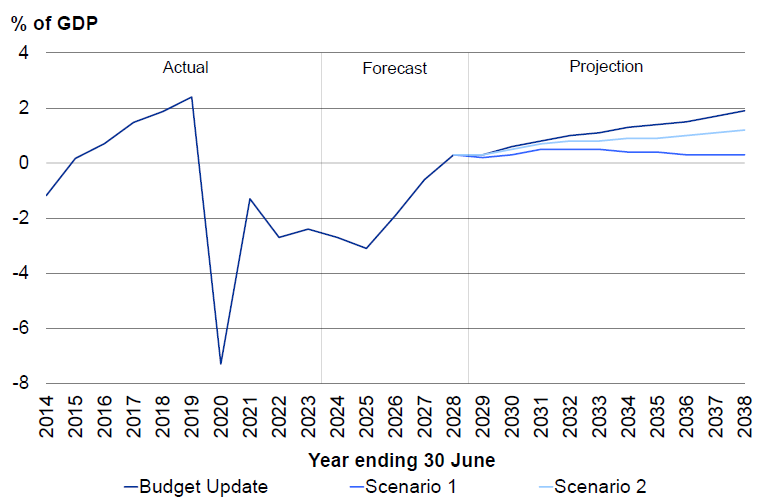

To highlight how sensitive the fiscal projections are to changing assumptions, we have included two scenarios:

- Scenario One: New operating expenditure in the projection period grows at $3.0 billion in the first year of the projections, inflated by nominal GDP (rather than in line with projected CPI inflation) in later years. This scenario illustrates risks to medium-term expenditure associated with a growing and ageing population (increasing cost pressures, particularly for health spending) and the projected capital expenditure (which will require increased maintenance spending). Under the scenario, the improvement in OBEGAL over the projection period would stall in the early years of the projection period, leading to a more gradual decline in net core Crown debt.

- Scenario Two: Labour productivity growth is assumed to be 0.7 per cent per annum, consistent with the 20-year average of labour productivity growth. This assumption is lower than the 1.0 per cent growth assumed in the baseline projections and illustrates the risk that the recent run of weak productivity data may turn out to be more persistent than currently expected. The scenario results in a material deterioration in the projections for OBEGAL and net core Crown debt. (Note that the scenario is not indicative of a change to Treasury's long-run assumption for productivity, which will be reviewed as part of the forthcoming Long-term Fiscal Statement.)

Figure 13 — Net core Crown debt scenarios

Source: The Treasury

Figure 14 — OBEGAL scenarios

Source: The Treasury