Operating allowances

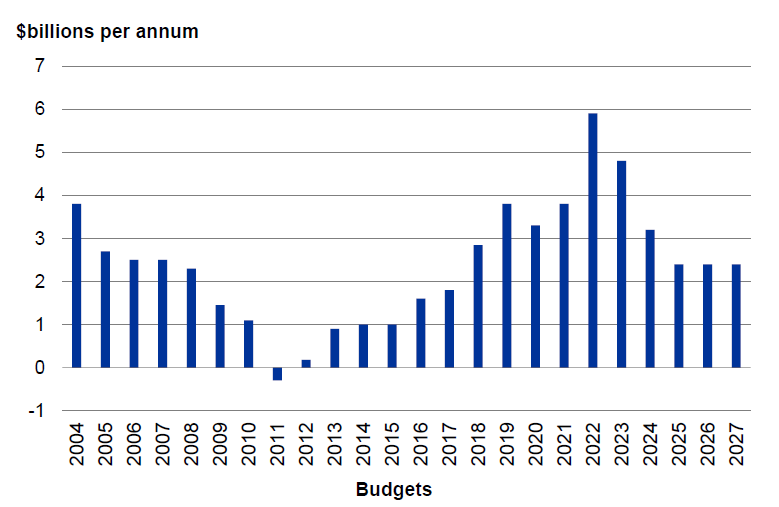

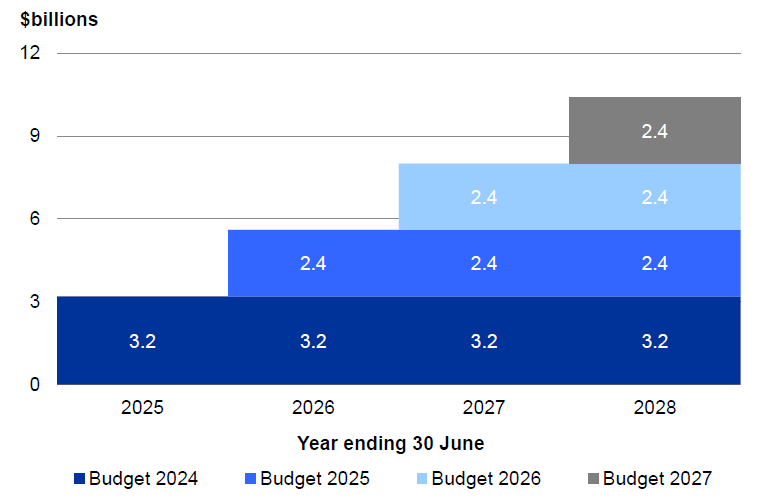

The final operating allowance for Budget 2024 is $3.2 billion (on average per annum). This is the lowest allowance since Budget 2018 (Figure 5) and the lowest allowance in real terms since Budget 2017. Compared to the $3.5 billion allowance in the Half Year Update (set by the previous Government), the Budget 2024 allowance represents $1.2 billion less spending over the forecast period.

Allowances are a net concept. The $3.2 billion allowance contains spending increases and revenue reductions (including changes to personal income tax thresholds and an increase to the In-Work Tax Credit), as well as savings and revenue initiatives.

Operating allowances for Budgets 2025 to 2027 will be $2.4 billion per Budget. These are tight allowances, especially compared to the allowances set in Budgets after 2017 (Figure 5). They are lower than the allowances in the Half Year Update (set by the previous Government) and lower than those in the National Party's pre-election fiscal plan.[5]

Figure 5 — Historical operating allowances

Source: The Treasury

Figure 6 — Budget operating allowances (average per annum)

Source: The Treasury

Overall, the lower allowances for Budgets 2024 to 2027 result in a cumulative total improvement in OBEGAL of approximately $5.5 billion across the forecast period compared to the allowances in the Half Year Update.

The Treasury estimates that $2.5 billion could be required to meet inflation and wage pressures across all expense areas in 2025/26. Managing within $2.4 billion allowances will therefore be challenging. The Government has committed $1.4 billion in each of Budgets 2025 and 2026 to meet cost and volume pressures in the health sector. Savings and reprioritisation will be a feature of future Budgets, just as they have been in Budget 2024.

The Government will make savings and reprioritisation a business-as-usual activity through:

- requiring government departments to prepare performance plans that focus on operating within baselines, highlighting options to manage cost pressures through reprioritisation, and mitigating fiscal risks

- targeted savings and revenue initiatives, including deep dive reviews, and

- system reform to increase fiscal discipline, including by amending the Public Finance Act.

Notes

- [5] The Half Year Update allowances were $3.25 billion in Budget 2025 and $3.0 billion in Budgets 2026-27. The National Party’s proposed allowances were $3.2 billion in Budget 2024, $2.85 billion in Budget 2025 and $2.7 billion in Budgets 2026-27.