Managing assets and liabilities

The Crown owns:

- physical infrastructure such as hospitals, schools and roads to support the delivery of public services

- financial assets that are predominantly held to prefund obligations for future spending, such as the NZSF and the Accident Compensation Corporation (ACC) investment fund, and

- ownership interests in commercial entities.

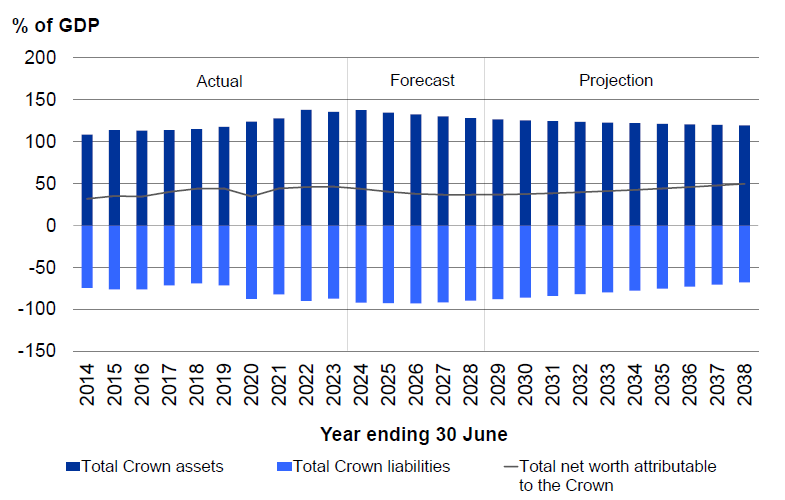

Total Crown assets are expected to reach $569 billion in 2023/24 - more than 50 per cent larger than five years ago. The Crown is also expected to have liabilities of $380 billion in 2023/24, two-thirds of which is borrowings. The difference between assets and liabilities represents the Crown's net worth.

Net worth attributable to the Crown is expected to remain relatively constant in nominal terms over the forecast period. It declines as a percentage of GDP before picking up again in the projection period (Figure 11).

Figure 11 — Net worth attributable to the Crown

Source: The Treasury

On the liability side of the balance sheet, the Government's priority is to stop using debt to fund operating cash flows (as has been happening since 2019/20). Debt should be used primarily to fund high-quality investments that provide benefits to New Zealanders over time.[9] Funding operating expenditure out of operating revenue, rather than debt, will help restore the Crown balance sheet's resilience to future shocks.

On the asset side, the Treasury's most recent Investment Statement (2022), drawing on Infrastructure Commission analysis, states that, historically, New Zealand has not built infrastructure well - with New Zealand ranking amongst the world's least-efficient high‑income countries when it comes to delivering infrastructure.

The Government's strategy for managing Crown assets is therefore to:

- strengthen investment disciplines, including better-planned investment proposals, more transparency and stronger central oversight

- improve project selection to deliver a more stable and sustainable investment pipeline that reflects the economy's capacity to deliver

- improve the performance of the Crown's existing assets in supporting service delivery, and

- use a broader range of funding and financing options, including the use of revenue tools and models that involve private capital.

Note

- [9] Other uses of debt are as a smoothing device, to allow automatic fiscal stabilisers such as tax revenue and unemployment-related benefit spending to operate across the economic cycle, and in the event of an economic shock such as a natural disaster or financial crisis.